It was a positive quarter for global markets, which did not look likely in early April when President Trump’s

tariff announcements rocked investors and governments worldwide. While news on tariffs was scheduled, the

high levels and reasoning behind them shocked investors who scrambled to reduce risk, fearing a significant

hit to economic growth.

Read our full thoughts on the quarter in our new Investment Commentary.

If you’d like to receive our quarterly commentaries via email, drop us a line.

Rocq Capital Management Limited is pleased to announce the appointment of Harry Bazzaz as its Chief Investment Officer. He takes over the position from John de Garis who has fulfilled the role since 2008 and continues as Managing Director of the Rocq Capital Group.

The move highlights the continued growth at Rocq Capital in managing portfolios and funds for private and institutional clients. It is now the largest privately owned, independent investment manager on the island with clients supportive of its ethos, performance and service. Rocq Capital offers liquid investment strategies to a wide range of clients.

Harry joined the company as an Investment Manager in 2017 and was appointed a director in 2023. He is a CFA Charterholder, a Chartered Wealth Manager, holds the Investment Management Certificate and is a Chartered Member of the CISI. He has an MA in Economics from the University of Cambridge. For the past two years Harry has also been Chair of the GIFA Managers’ Committee, representing the investment sector locally.

We are delighted once again to be sponsoring The Liberation Day Party at L’Eree on Friday 9th May. The celebrations run throughout the day and there is plenty for all to enjoy and mark the 80th Anniversary.

We are particularly pleased with this Souvenir Programme that highlights Remembrance of the Occupation and the Celebration of its Liberation. We hope you enjoy reading it and planning your day with us out West.

Activities start at 10:00 and run through to 23:00 with plenty of entertainment and live music in the marquee all day. Food and refreshments aplenty are served all day.

We are honoured that Her Royal Highness The Princess Royal is coming to L’Eree (14:30) to meet veterans, evacuees and volunteers. The RAF Falcons Parachute Display Team will be dropping in to the beach (15:00) and a Spitfire fly pass is scheduled (19:00).

There are plenty of children’s activities on the Beach and Common whilst the historical tent features wartime artefacts, stories and memorabilia.

We do hope that you will join us. The Rocq Team will be there in force and we look forward to celebrating with you.

The words and actions of Donald Trump have been the main driver of markets during the first three months of the year as a series of pronouncements drove volatility, particularly in March which ended with a weak tone.

Read our full thoughts on the quarter in our new Investment Commentary.

If you’d like to receive our quarterly commentaries via email, drop us a line.

The outperformance of US equities compared to other regions has been impressive, and it is likely that the American economy will be relatively strong in 2025.

Read our full thoughts on the quarter in our new Investment Commentary.

If you’d like to receive our quarterly commentaries via email, drop us a line.

The sentiment surrounding US interest rate expectations changed markedly during July with expectations

building that the Federal Reserve (Fed) would cut rates by just over 1% through the remainder of this year.

Read our full thoughts on the quarter in our new Investment Commentary.

If you’d like to receive our quarterly commentaries via email, drop us a line.

Rocq Capital is pleased to announce the appointment of Chris Gambrell as a Non-Executive Director to the Board of its in-house funds. Chris makes a welcome return to the investment fund sector having been Founder and Managing Director of Praxis Funds (2005 – 2018). More recently Chris has been providing strategic advice to businesses in fund management and fund administration. He also advises local retail and healthcare businesses.

Stuart Perfitt, Executive Chairman of Rocq Capital said ‘Chris comes with a formidable track record and his expertise and insight will bring great benefit to our fund offering for which we have ambitions to grow. Having been an investor with us for several years he knows plenty about Rocq Capital, our approach, people and style. We look forward to his input and advice in helping us to grow these locally based funds. We are delighted to have him onboard.’

Chris commented ’I have known the team at Rocq Capital for several years. They are a pleasure to deal with, operating to excellent professional standards, combined with a lengthy track record and experience in asset management. Upon being approached to consider appointment to the Board of their in-house funds, I jumped at the opportunity, and I look forward to assisting with the growth of the funds.

Rocq Capital is pleased to announce that CJ Peatfield has joined the company as an Investment Manager coupled with a Business Development role.

CJ is a Chartered Member of the Institute of Securities and Investment, holding the International Certificate in Wealth and Investment Management and the Investment Advice Diploma.

CJ previously gained Corporate Service and Private Wealth experience with an international trust company before moving into wealth management at a local fiduciary and investment business, where he would later become a director of the fund management company.

John de Garis, Managing Director commented that ‘CJ’s arrival is extremely welcome as we continue to grow the Rocq brand and business. We are seeing an influx of new mandates and additional inflows from our existing clients which speak volumes for the performance and service we provide.’

‘To recruit such an experienced manager like CJ who has natural interpersonal skills is a great addition for the team. Given the number of changes in the local investment management scene we are seeing greater interest in our business as we are independent and remain committed to the island. Our community events typify what we are about as a locally owned and focused entity’.

‘Whilst already well qualified CJ will greatly benefit from working with the experienced managers that we have in situ. The team are already harnessing the energy and enthusiasm that he brings and we look forward to working with him for the benefit of all our clients’.

CJ says ‘I’m delighted to join Rocq. It’s been particularly pleasing to see Rocq’s rigorous approach to managing money and commitment to high levels of client service. I look forward to helping Rocq on their upward trajectory.’

Rocq Capital is a locally owned, independent investment manager providing discretionary portfolios and funds for local private clients, pensions (RATS), trusts, captive insurers and government.

It was a reasonable quarter for equity markets, despite declines in April, as corporate earnings and disinflation trends underpinned sentiment in stock markets.

Read our full thoughts on the quarter in our new Investment Commentary.

If you’d like to receive our quarterly commentaries via email, drop us a line.

Rocq Capital has renewed its partnership with Rewild Carbon, a nature-based solution established by Durrell Wildlife Conservation Trust, a charity headquartered in Jersey with a global reputation. By continuing our financial contribution, we can have an immediate positive impact in combatting climate change, reviving ecosystems and protecting biodiversity. Working together, our goal is to reduce carbon in the atmosphere by restoring forest corridors to create lifelines for wildlife allowing us to give back to nature positive, meaningful, and long-lasting changes.

We would encourage others to consider this project in order to make an immediate impact rather than setting targets for change many years from now. We will continue to look at ways in which we can reduce our day-to-day environmental impact, but this collaboration gives us the best immediate and local solution to a global problem.

Please find our certificate here.

Equity markets performed well in the first three months of 2024. The release of strong corporate earnings from several key US stocks, such as NVIDIA, Microsoft and Meta, was influential in buoying sentiment and pushing up global markets.

Read our full thoughts on the quarter in our new Investment Commentary.

If you’d like to receive our quarterly commentaries via email, drop us a line.

It was a positive quarter for financial markets, despite an extremely poor month in October, as in the final few weeks of the year movements in government bond yields provided the foundation for broader gains across credit and equity markets.

Read our full thoughts on the quarter in our new Investment Commentary.

If you’d like to receive our quarterly commentaries via email, drop us a line.

September marked a possible conclusion to the interest rate hiking cycle in place since the start of 2022 with the US Federal Reserve (Fed) and the Bank of England deciding to keep rates unchanged, and the European Central Bank raising rates but signalling that it may be the final move in its rate hike cycle.

Read our full thoughts on the quarter in our new Investment Commentary.

If you’d like to receive our quarterly commentaries via email, drop us a line.

Rocq Capital is pleased to announce that Elliott Crowson has joined the company as an Investment Manager.

Elliott holds the CISI Investment Advice Diploma, the Certificate in Private Client Investment Advice & Management and has completed the Chartered Wealth Manager qualification. He is also a graduate of the University of Brighton where he achieved an LLB Law with Business degree.

Elliott previously gained investment experience at Ravenscroft and at Credit Suisse locally where he held a relationship management position.

John de Garis, Managing Director commented that ‘Elliott’s arrival is well timed as we continue to grow the business. Already well qualified he will greatly benefit from working with the experienced managers that we have in situ. The team will equally benefit from the energy and enthusiasm that he brings and we look forward to working with him for the benefit of our clients’.

Elliott says ‘I am delighted to join the Rocq Capital team and hope to make an impact from the outset. We are growing quickly so I am grateful for the opportunity to contribute towards the continuing success of the firm, and look forward to helping ensure clients always receive the highest standard of service.’

Rocq Capital is a locally owned, independent investment manager providing discretionary portfolios and funds for local private clients, pensions (RATS), trusts, captive insurers and charities. Its team of twelve has oversight of over £400m of assets.

![]()

![]()

Rocq Capital has been committed to introducing sustainable investments to portfolios for some time and we have developed a Responsible Investing Policy to articulate this goal in our day-to-day investment work.

Alongside this, we are aware that when running our company, we need to carefully consider its environmental impact. As a result, we have undertaken a project to calculate our carbon footprint and taken steps towards minimising our impact and where possible balance this with positive actions.

To this end, Rocq Capital has recently partnered with Rewild Carbon, a nature-based solution established by Durrell Wildlife Conservation Trust, a charity headquartered in Jersey with a global reputation. By making a financial contribution now, we can have an immediate positive impact in combatting climate change, reviving ecosystems and protecting biodiversity. Working together, our goal is to reduce carbon in the atmosphere by restoring forest corridors to create lifelines for wildlife allowing us to give back to nature positive, meaningful, and long-lasting changes.

We would encourage others to consider this project in order to make an immediate impact rather than setting targets for change many years from now. We will continue to look at ways in which we can reduce our day-to-day environmental impact, but this collaboration gives us the best immediate and local solution to a global problem.

Please find our certificate here.

It was a mixed quarter in financial markets, with momentum lost after a strong Q1 across equity and bond markets.

Read our full thoughts on the quarter in our new Investment Commentary.

If you’d like to receive our quarterly commentaries via email, drop us a line.

We are delighted to appoint Harry Bazzaz to our board, as Investment Director.

Our MD, John de Garis, commented: “Harry is an integral part of the investment team and has been managing portfolios for clients in an effective and clear way. He has rightly been promoted to the Board and will be able to help shape our future development.”

Read the full article below 👇

https://channeleye.media/rocq-capital-appoints-new-board-member/

Markets had an extremely strong start to the year in January, though this faded and reversed slightly in February and March as concerns about growth and the banking sector came to the fore.

Read our full thoughts on the quarter in our new Investment Commentary.

If you’d like to receive our quarterly commentaries via email, drop us a line.

Inflation has been the most important theme in markets this year, and that continued in the fourth quarter albeit in a different direction.

Read our full thoughts on the quarter in our new Investment Commentary.

If you’d like to receive our quarterly commentaries via email, drop us a line.

As in the first half of the year financial markets exhibited considerable volatility in the third quarter, notably in the last few weeks.

Read our full thoughts on the quarter in our new Investment Commentary.

If you’d like to receive our quarterly commentaries via email, drop us a line.

We are excited to announce that Rocq Capital has started using FutureTrack to transform its sustainability by measuring, managing, minimising and benchmarking its environmental impact. FutureTrack will help us to embed environmental, social and economic sustainability into its organisational DNA, and to make positive, meaningful, and long-lasting changes for a better future.

Find our more: https://esimonitor.org/

![]()

The continuation of tough market conditions has led 2022 to record the weakest first half in equity markets since 1970 (measured by the S&P 500), driven in part by central banks raising interest rates and their hawkish narrative suggesting significant further increases over the remainder of the year.

Read our full thoughts on the quarter in our new Investment Commentary.

If you’d like to receive our quarterly commentaries via email, drop us a line.

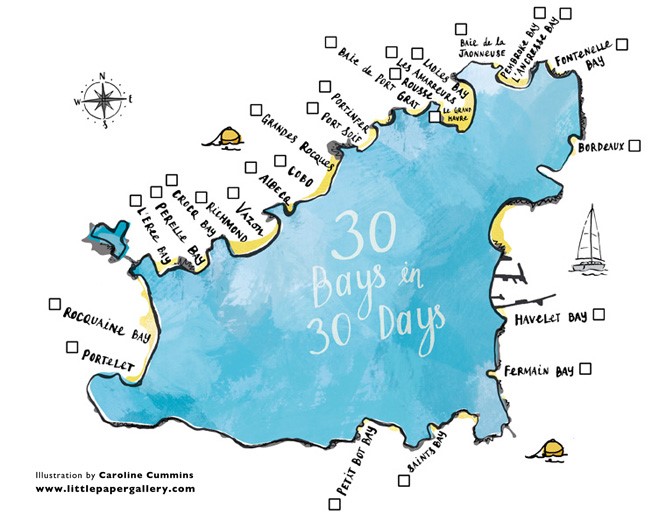

The team at Rocq are pleased to be sponsoring this popular local event once again.

30baysin30days kicks off on the 1st of July, with the first taking place at Vazon (6:30pm) and the last at Cobo on the 30th of July, but you can swim the other bays on the list in whichever order, whenever you like.

Full details can be found here 👇

www.30bays.org

Russia’s invasion of Ukraine in late February prompted significant volatility in financial markets across all asset classes, which was exacerbated by the announcement of unprecedented sanctions on Russia by Western

governments.

Read our full thoughts on the quarter in our new Investment Commentary.

If you’d like to receive our quarterly commentaries via email, drop us a line.

Rocq Capital teamed up with Guernsey Trees for Life (GTFL) on the second weekend in February to plant 60 trees on a site in St Pierre du Bois. The trees were provided by GTFL and were native species, such as elder and birch. The objective was to introduce new trees to a small pocket of land to improve the bio-diversity and encourage more wildlife, birds and pollinators in the area. GTFL is currently undertaking a number of planting projects through the winter months which will lead to 1000s of trees and hedging plants being introduced across the island.

The quarter started strongly in equity markets with more than 80% of companies in the S&P 500 beating Q3

earnings expectations, pushing the index to a new all-time high.

Read our full thoughts on the quarter in our new Investment Commentary.

If you’d like to receive our quarterly commentaries via email, drop us a line.

As asset managers Rocq Capital has been clear and committed in its responsibility to the environment over many years and has done much to reduce, reuse and recycle. We have now gone a step further and teamed up with ESI Monitor and enrolled in its Environmental Business Operations Framework to help us measure, manage, minimise, and continually improve our environmental footprint.

This important development is driven by the Rocq Capital team and we know it will be supported by our clients and partners who are all looking at ways to help protect that most important asset of all – the planet.

Check out our Responsible Investing page for more information.

Rocq Capital is pleased to report that its two new colleagues have settled in really well. Kim Hunt and Dan Moore recently bolstered our team as Rocq Capital continues to grow and flourish. We celebrated our 5th birthday earlier this year and we continue to provide a high level of performance and service to our ever growing band of followers that include private clients, trusts, pensions (RATS) and captive insurers.

Kim joined Rocq Capital as Accounts Manager and Company Secretary in March this year.

“Coming from a Trust background, I was a little apprehensive about switching to an investment house but I am happy to say that it has proven to be both an interesting and rewarding experience. Rocq make me feel that my “back office” contribution to the business is highly valued and it is a great privilege to work on a daily basis with a team of engaged professionals who are so obviously interested in their chosen field.”

Dan has joined as a trainee Investment Manager following his graduation from Brighton Business School. He aims to complete his Investment Advice Diploma through the Chartered Institute for Securities and Investment. He has commented on his start;

“I have thoroughly enjoyed the introduction to my career in investments at Rocq Capital. The team have been extremely welcoming and have ensured my start has been both educational and stimulating. It has been a pleasure to work alongside individuals with such extensive industry experience and I have found this has contributed to an elevated understanding of different components that make up the various markets. I look forward to continuing my work with the team and expanding my abilities within the job role.”

It was an eventful summer in the markets with some significant global developments and moves within asset

classes, particularly in September.

Read our full thoughts on the quarter in our new Investment Commentary.

If you’d like to receive our quarterly commentaries via email, drop us a line.

Congratulations to the Guernsey Padel Team who celebrated a 36-15 victory against Jersey in the inaugural Corcuera Cup Inter-Insular.

The weekend involved 51 games through which both Islands battled for points at the Guernsey Tennis Centre.

An exceptional blend of showmanship, talent and commitment towards this growing sport resulted in a truly successful weekend that both islands can be proud of.

Rocq Capital looks forward to continuing its support for the Corcuera Cup and wishes both teams the best of luck for next year’s competition in Jersey.

The continued roll out of COVID-19 vaccines supported the further rally of global equities during the second quarter.

Read our full thoughts on the quarter in our new Investment Commentary.

If you’d like to receive our quarterly commentaries via email, drop us a line.

In an attempt to mitigate the impact of the coronavirus outbreak the States of Guernsey has ordered the island into lockdown mode from 25th March for an initial period of fourteen days. We applaud the authorities for this action designed to keep islanders, our colleagues, clients and contacts safe.

Rocq Capital activated its well-rehearsed business continuity plan last week with the team working remotely. This enables us to operate as normal without delay or any reduction in service standards. The office is now closed until further notice and all telephone calls are being diverted to our Office Manager who will point you in the right direction. Email traffic is uninterrupted and will be responded to as normal. If you have a general enquiry please use info@rocqcapital.com.

We look forward to seeing you again, in person, once the virus has cleared and the authorities deem it safe to do so. We will update this webpage in order to keep you posted.

Keep safe.

Rocq Capital

It was a tumultuous quarter for financial markets, reflecting the upheaval experienced by society as a whole due to the coronavirus pandemic. With many businesses closed or operating well below capacity, and demand severely curtailed by the current circumstances, stocks and corporate bonds experienced heavy sell-offs.

Read our full thoughts on the quarter in our new Investment Commentary.

If you’d like to receive our quarterly commentaries via email, drop us a line.

Rocq Capital supports 30 Bays in 30 Days!

Rocq Capital is delighted to be supporting the 30 Bays in 30 Days event organised by Les Bourgs Hospice again this year. It is a great way to explore Guernsey and make the most of this year’s summer staycation challenge on our beautiful island. Even better it is for a great cause as all proceeds are for the benefit of Les Bourgs Hospice.

Find out more by clicking on the map or visiting www.30bays.org

2020 is a year in which it seems time has sped up, weeks feel like months and months feel like years. It was merely three months ago when investment markets were pricing in a significant global recession. However the reopening of economies as the perceived threat of coronavirus fell away somewhat, swift and dramatic policy response from governments and central banks, led to a sharp about turn in markets.

Read our full thoughts on the quarter in our new Investment Commentary.

If you’d like to receive our quarterly commentaries via email, drop us a line.

Rocq Capital has recently celebrated its 4th birthday and is looking forward to the future.

On the last weekend of August, Rocq Capital was proud to support the inaugural Rocq Capital Island Padel Championships. What a fun weekend playing the fastest growing sport in Guernsey! Congratulations to all the winners.

Photos courtesy of the Padel Tennis Club Guernsey.

This has been the quietest quarter of the year so far in markets, having neither the precipitous drops of Q1 nor the spectacular rallies of Q2. Nonetheless, there have been significant moves in a variety of asset classes and the high dispersion of returns between sectors and regions has continued.

Read our full thoughts on the quarter in our new Investment Commentary.

If you’d like to receive our quarterly commentaries via email, drop us a line.

Brexit, US Elections, and pandemic vaccines were amongst the drivers of market moves in the fourth quarter.

Read our full thoughts on the quarter in our new Investment Commentary.

If you’d like to receive our quarterly commentaries via email, drop us a line.

Back by popular demand – The Hidden Gardens of St Peters

Financial markets underwent a significant shift during the first quarter of the year.

Read our full thoughts on the quarter in our new Investment Commentary.

If you’d like to receive our quarterly commentaries via email, drop us a line.